Key Takeaways

- SME owners should understand the difference between Enterprise Value, Equity Value, and Net Proceeds because each metric has a different meaning and importance.

- When undertaking a value creation mindset, owners should focus on managing their businesses’ enterprise value and equity value.

-

Understanding these metrics should be done in conjunction with a detailed financial retirement plan.

Overview

Quite often, business owners ask “What is my business worth?” What they really want to know is how much money will be in their pockets after all taxes and transaction costs have been considered (or, in other words, the net proceeds upon disposition). This may ultimately be a much different number from two other types of figures that are often thrown about when a person’s business has been appraised: i) equity value and ii) enterprise value. Let’s take a closer look to explore how to define equity value and enterprise value along with why SME owners should understand (and manage their business) with these two figures in mind.

Enterprise Value

The enterprise value of the business is the value of the entire business irrespective of that organization’s capital structure. The enterprise value tells us the worth of the real underlying business. The choices of how the company is financed (either through debt, equity, or hybrid instruments) is a management decision made by the business owner based upon their preferences, risk tolerances, and constraints put on the owner by the marketplace. For example, the bank will not agree to overleverage the business by issuing debt to the owner that has not put in enough equity (in other words, in the eyes of the bank they don’t have enough skin in the game). Similarly, enterprise value tells us how much a business is worth regardless of how many shareholders have a claim to the enterprise’s cash flows. Think of a public company that may have millions of shareholders. An individual shareholder may only own $10,000 worth of equity, but the enterprise value of that business could be in the billions. This idea also holds true for SMEs except the number of shareholders is significantly less than found in public companies. Regardless, the true worth of the company can be encapsulated by its enterprise value since it is independent of other management decisions such as capital structure, tax structuring, and estate planning. Enterprise value is maximized through excellent strategy, execution, values, driven purpose, human capital (“the right people in the right seats[1]”) and having a strong grip on the cash flows of the business.

Equity Value

Every business is composed of an invested capital that ultimate funds the business operations, its assets, and its working capital. Invested capital is commonly broken down into debt and equity. For most middle market businesses, debt commonly includes operating lines of credit, bank term loans, and related party debt (often from the shareholders of the businesses themselves). This type of simple debt does not provide any ownership characteristics in and of itself. Aside from debt, companies are funded through equity ownership in common voting shares. If the family is involved in the business, it is common to see more complex share arrangements using both common and preferred shares (which is especially true if an estate freeze has ever been enacted). Preferred shares are similar to debt in that dividends may be paid to holders on a regular schedule but such shares may also have other features such as voting and convertibility that make these shares more display characteristics of equity than debt. Lastly, common shares generally provide the holder with voting power (to some degree) and a share in the future cash flows of the business or rights to liquidation proceeds once creditors and preferred shareholders have first taken their share upon the closing of a business (either voluntarily or through liquidation).

To most business owners, the value of their holdings of the common equity is what is most relevant to them. Keep in mind that if there are multiple shareholders, each shareholder has a claim on the future cash flows of the company and so the equity value of the business must be divided up amongst the various common shareholders[2]. To keep things simple, let’s assume a business only has one shareholder with bank debt and no preferred shares. That shareholder’s equity value is dependent upon the level of debt assumed by the organization since the debt holder (in this case, the bank) has first claim on the organization’s assets. To determine the shareholder’s equity value, we first need to know enterprise value and then subtract the fair market value of debt (and preferred shares if there are any). Sellers traditionally focus on equity value because that is their claim on ownership interest in the company.

Equity value is maximized both through enterprise value considerations as well as prudent capital allocation. In other words, using borrowed money, when possible, to fund the growth of the company. When equity investments are required, it is important to understand that you are now sharing a piece of the pie with others. The pertinent question then is whether you will then have a smaller piece of a bigger pie, or simply diluting earnings to others, so brand new partners should be ideally bringing something to the table beyond just passive money.

Net Proceeds

When an owner transfers or sells their shares (or alternatively sells the assets of the corporation), a taxable transaction is created. In the case of an asset sale, tax consequences will occur at both the corporate and personal levels. Selling or transferring a business will also incur a significant amount of accounting and legal fees along with commissions if a broker or intermediary were used. Thus, the net proceeds obtained by a business owner after exit will be less than the equity value of the shares. With poor planning (or none at all), taxes and transaction costs can be significant when the final tally is made. When bragging about what their business sold for at the local golf club, they likely aren’t telling their friends about the net proceeds.

To maximize net proceeds, one has to engage in not only enterprise value enhancement projects and prudent capital allocation management (to optimize equity value), but now must also engage in comprehensive business succession, estate, and tax planning.

Why Does it Matter?

Each of enterprise value, equity value, and net proceeds are important to understand and plan for, however, how one manages each of these metrics requires different approaches. Traditionally, net proceeds is the metric most managed through both efficient tax structuring and effective estate planning. In addition, risk management measures such as an effective shareholder agreement that addresses the Five Ds (Death, Dispute, Divorce, Disability, and Distress) can avoid adverse consequences of an untimely and involuntary exit.

Once the above has been considered, equity value then becomes a function of capital structure. In other words, how is growth in the company going to be fueled? Through debt (and if so, is it senior, junior debt, or mezzanine), equity, or some hybrid of both debt and equity? Owners would always prefer to use debt if they could[3] but in cases where lenders cannot be found, some equity participation may be necessary, even to the point where control of the company must be relinquished. The question then is whether it is better to own 100% of a stagnant company or 49% (or less) of a growing company? Are the equity partners simply providing funds and acting as silent owners or are they active and contributing towards the business’ growth.

Lastly, to maximize enterprise value, value creation strategies have to be employed. In the Middle Market, this is the area most often ignored but this concept is implicitly understood by both public companies and private equity. This involves strategy, putting together a strong entrepreneurial organization, effective leadership, getting the right people in the right places, excellent execution, and prudent enterprise risk management. It is difficult yet can be the most rewarding aspect of entrepreneurship. This is the heart of value acceleration.

Correlating Value to a Financial Plan

If you are a business owner, and you are just starting your exit planning journey, you need to understand both what your company is worth and then correlate that to a post-retirement financial plan. If your net proceeds are less than what your financial planner says you need to retire comfortably, then there is a value gap that needs to be solved. The value gap can be addressed through a coordinated value acceleration program that will incrementally work on increasing your company’s enterprise value, equity value, and ultimately the net proceeds upon your exit.

A Holistic Approach

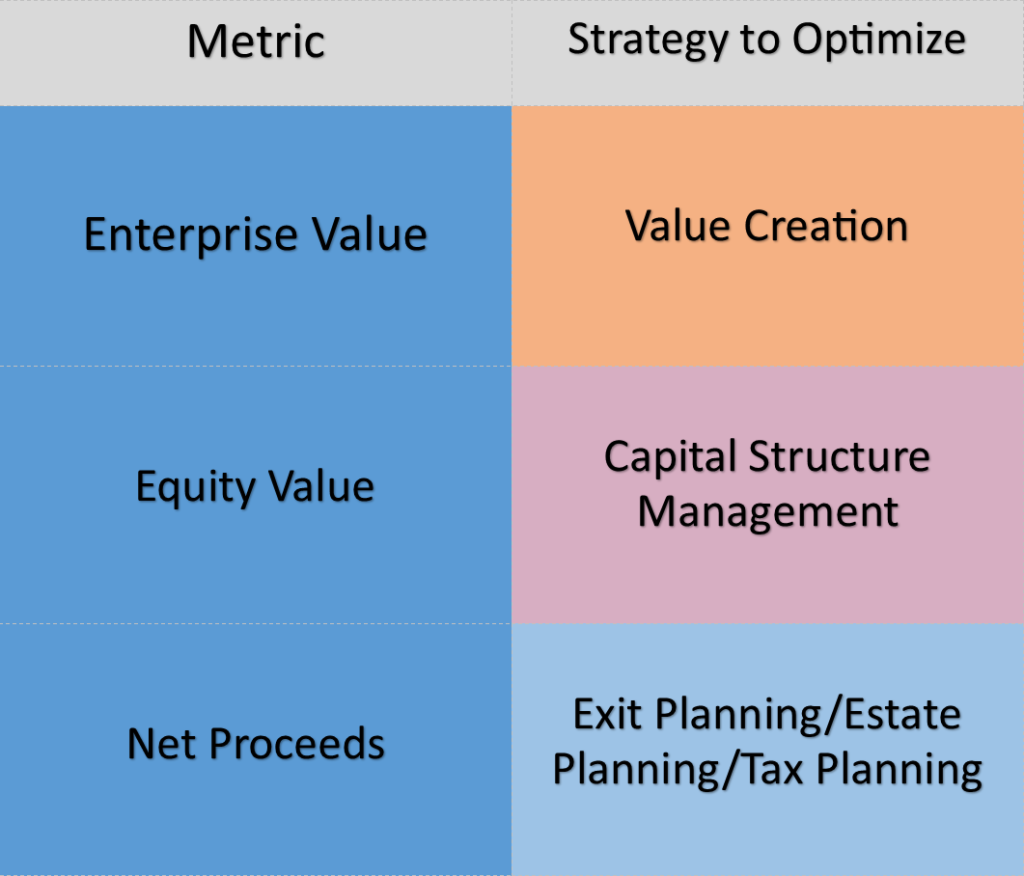

In Figure 1, I have outlined the three main value metrics owners should be concerned with and the primary strategies used to optimize these values as discussed above. The important thing to take away from this is that all owner-mangers must at some time be concerned with all three value metrics to optimize their business from a purely financial perspective. (Note that there are other non-financial considerations such as legacy, family, employees, etc. that are also important but beyond the scope of this article’s discussion points.) Traditionally, more focus has been placed on estate and tax planning with little consideration to exit planning. While Middle Market owners understand it is always better to use someone else’s money to grow the company, there is little understanding of what optimal capital structure is and how this can be managed to improve the equity value of the owners. Lastly, again while many owners implicitly understand the concepts of value creation, much of this is focused on the top line with sometimes minimal consideration to cash flows and profitability. In addition, by bolstering the various functions of the company such as finance, operations, human resources, IT, sales, and marketing, the owner can take a step back and start to view their business more strategically with a big picture in mind. Adding in an entrepreneurial infrastructure (ensuring that vital communication flows both from the top to the bottom of the organization as well as bottom-up) can help to create an organization that is not single-handedly run by the owner but rather a living, breathing machine.

The figure below also indicates that owners focused solely on growth and running their business need to also give considerations to capital structure and planning because ultimately each of these steps works towards optimizing an eventual exit from a pure financial perspective (and if exit planning is done correctly, non-financial considerations will also be incorporated). For example, one can implement value creation strategies but la ack of estate, tax, and exit planning will result in less than optimal net proceeds. Similarly, formulating sound tax and estate plans won’t make up for a lack of value creation or capital allocation strategies.

Figure 1—A Holistic Approach to Owner Management

Summary

- To optimize net proceeds, good estate, tax, and exit planning are required.

- To optimize equity value, corporate finance (re: debt and equity) strategies need to be employed.

- To optimize enterprise value, value acceleration strategies need to be effectively planned out and implemented.

- When working under a value creation mindset, owner-managers need to manage their business with the objective towards maximizing enterprise value and equity value on top of addressing exit, estate, and tax planning needs.

[1] Read Jim Collins “Good to Great”.

[2] The division of common equity is not always done on a proportionate basis to ownership but may involve discounts for lack of control and/or marketability. However, the discussion of some of the complexities surrounding this is beyond the scope of this article.

[3] The cost of debt is almost always lower than the cost of equity.