Key Takeaways

- As part of a value creation mindset, SME owners should concentrate on activities that increase enterprise value.

- Such activities can either focus on providing or supporting sustainable growth or de-risking the company’s cash flows.

- Attempting to make giant improvements all at once will likely end in failure. Start now by picking one or two major improvements to make then over time, you can make material increases to your enterprise value.

Value Creation Activities

In my last article, I outlined how activities in managing a business can be broken down into three categories: those that are meant to target

- Enterprise value;

- Equity value; or

- The ultimate net proceeds once a business has been transitioned.

In today’s article, I am going to provide an overview of activities that are intended to enhance a business’ enterprise value. The enterprise value reflects the true economic health of the business irrespective of how that business is financed. It does not represent what an owner will pocket after they have sold the business (or transitioned it to other parties such as employees or family members) but rather reflects the true value of the enterprise most often based on its expected future cash flows (or in some cases, the assets of the business). If an SME owner is going to adopt a value creation mindset, they should be aware of their business’ enterprise value on a periodic basis (at least once per year) and prioritize to optimize it.

Enterprise value can be increased by two types of activities:

- Those that promote sustainable growth in the business; and

- Those that de-risk the business.

Many middle market businesses often neglect the de-risking side of the equation as their efforts or more focused on topline growth. The reality is that both types of activities are important if you want to grow the enterprise value of the business. While de-risking may not be as exciting as growing revenue, it is these activities that can have a big impact on how outsiders view the risk associated with your business generating cash flows. Anything that can negatively impact your business’ ability to generate and grow cash flow is a risk that needs to be managed, and if possible, mitigated.

On the growth side, it is important to understand that topline growth is fine so long as new business being brought in is going to ultimately increase cash flows and not increase the risk of the business (or if there is an increase in risk, the return from that increased risk is appropriately compensated). Sometimes, management will make the mistake of using strategies that increase revenue but narrow margins. Under such circumstances, it is important to ensure that this business is not actually producing negative margins once all overhead costs have been considered. Also, growth can be expensive, and managing working capital is critical since cash crunches can occur with the owner suddenly finding themselves short of cash because they didn’t monitor it.

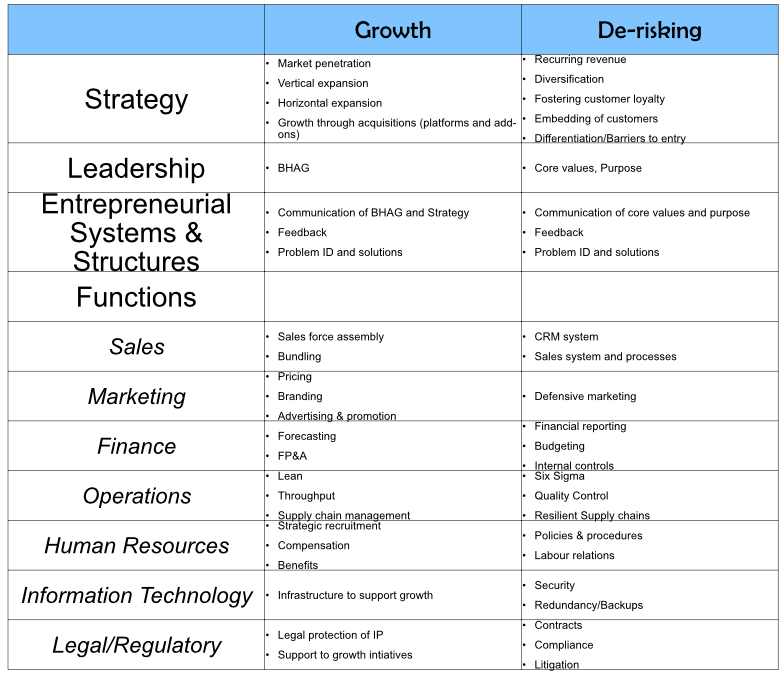

Below in Figure 1, I outline some of the key components of managing enterprise value (and thus value creation) that SMEs should consider. Some of these are obvious such as focusing on sales but other components are also important in the maturation of a business from a lifestyle business to one fueled by value creation strategies. This list is not meant to be exhaustive but rather provide some key examples for your consideration. I have divided the various activities into four main categories:

- Strategy;

- Leadership;

- Entrepreneurial systems and structures; and

- Functional areas.

Figure 1—Value Creation Activities

Strategy

Growth

As an SME owner, growth can be contemplated through a strategic plan to increase revenues. Growth can be achieved either organically (through horizontal, vertical, or geographic expansion) or engineered through acquisitions. Horizontal expansion involves adding new product lines and services. Such additions can be done for the purposes of diversification or because they are synergistic (i.e. add-ons to existing products or services). Vertical expansion involves bringing a key input of your product or service in-house. For example, to solidify your manufacturing process, a company may decide to produce a key ingredient in-house to ensure that the key input is available without risk of shortages or unforeseen price increases. Market penetration strategies often involve expansion into new geographic markets but can also involve the efforts associated with adding new products and services. Lastly, strategic alliances can also be considered where synergies between two or more companies can be explored so that mutually complimentary products or services can be combined to create new sources of revenue.

De-risking

A key part of enterprise value is that there is risk associated with achieving future cash flows by a business. The more things an SME owner can do to reduce that risk, the higher the potential enterprise value, holding everything else constant. Two areas often proving to be the downfall of many SMEs is that revenue is non-recuring and there being too much economic reliance on one or two key customers. In cases where these two issues are extremely negative, the business may not be transferrable at all (and if it is, you likely will see a very low multiple of cash flow). It is important for all SME owners to understand: cash flow is less risky when it is predictable, recurring, and diversified. Step one in de-risking your business is addressing shortcomings in this area. Other strategic initiatives which de-risk the business including fostering customer loyalty (which can be done through effective marketing, sales, customer service, and product/services quality). In addition, the concept of embedding your product or service into a customer such that the cost of substitution is so great, the customer is incentivized to continue doing business with you. Finally, it is important to differentiate your product or service from your competitors since there is no pricing power with a commoditized offering whereas an effective and unique solution on the market can achieve highly profitable value-based pricing.

Leadership

Growth

In Jim Collins’ Built to Last, he discusses the concept of a Big Hair Audacious Goal (or BHAG for short). A BHAG is a long-term goal that an owner should set for their company to achieve over a five-to-ten-year period. The idea is to aim high but temper this goal with two limitations: i) it should be something you are good at and ii) you have the ability to be number one in your field. Once you have a BHAG formalized, your intermediate to short-term growth plans can be centred around this by working your ways backwards. For example, what do you need to do to achieve this goal over the next three years? One year? Next 90 days? Next month? With a clear vision of where you want to go, you can start to strategically plan out the future much like a road trip. If you don’t have a destination in mind, who knows where you and your organization will end up in the future.

De-risking

Jim Collins also speaks of core values and purpose for an organization. Purpose speaks to the why of the business. In other words, why does this business exist outside of simply making money? Core values addresses what intangible qualities are important to the business and then attracting and retaining talent that are aligned with these core values (and letting those who are not aligned go elsewhere). In a way, having a team aligned with your core values and clearly defining your purpose are, at a strategic level, a type of de-risking exercise that act as curb on the organization’s activities. Those activities that do not align with the core values of a business or fit with its purpose should be avoided (or stopped if they are currently ongoing). This prevents wasting valuable time and resources on non-core activities.

Entrepreneurial Systems and Structures (ESS)

ESS are intended to provide the framework and infrastructure to:

- Communicate concepts such as the BHAG, core values, and purpose throughout the organization;

- Provide timely feedback (bottoms-up and top-down); and

- Provide a mechanism for problem identification and solving throughout the organization.

Popular ESS methodologies such as Rockefeller Habits (or Scaling Up) and EOS are examples of formalizing a structure within an organization to address the above three objectives. However, SME owners can apply the concepts found in Good to Great and Built to Last along with other management books to create their own organic entrepreneurial systems that resonate with their own personal styles. The important point, though, is to have a consistent system in place that allows the owner to separate themselves from their business. If the business and owner are intrinsically the same, then the business is not transferrable. Creating an ESS within an organization helps to not only improve transferability but improve the performance of the business and remove bottlenecks.

Functional Areas

Each of the functional areas listed in Figure 1 can address both growth or de-risking initiatives, although some functions such as legal lean more strongly on the de-risking side of the equation versus sales which is intrinsically intended as a growth function. However, even in such situations, activities can be performed which can support both growth and de-risking. For example, on the sales side, documenting the sales process and implementing a strong CRM system can help provide a transferrable structure to a prospective buyer, thus de-risking the business since a proven method of selling goods or services have been discovered and then formalized into a process. In the case of legal, while it is essentially a de-risking exercise, it provides a much needed backbone to support growth initiatives such as IP protection, and prudently worded agreements with customers, suppliers, or affiliate partners, without which such growth initiatives may never get off the ground.

Many SME businesses lack important things which ultimately help to support and grow enterprise value. The most commonly seen are:

- A lack of formalizing and documenting a sales system;

- Lack of an intellectual property strategy;

- An inability to financial forecast your company’s cash flows or monitor the performance of the company on a timely basis;

- The lack of identifying and tracking key performance indicators;

- Throughput (bottleneck) issues in operations;

- Non-optimized or non-resilient supply chains;

- Not assigning strategic importance to the human resources function;

- An IT infrastructure that inadequately supports the company’s growth objectives;

- Skimping on legal de-risking measures thus leaving potentially large financial time-bombs or enterprise value destroying risks unaddressed.

Conclusion

As part of a value acceleration process, SME owners should begin to address shortcomings noted above. Implementing these changes cannot be done over night so it is prudent to address the most important things first and over time adding layers to the existing infrastructure. By doing this, when it comes time to transfer your business, you will be in a far better position to transfer your business and achieve a higher multiple than