Introduction

There are three gaps that SME owners have to consider:

- the wealth gap;

- the income gap; and

-

the value gap.

In this article, we will take a look at why managing and eliminating such gaps is important to business owners on their road to growing their business with an exit in mind.

Wealth Gap

The wealth gap exists when there is a difference between the nest egg you need to retire comfortably (according to your own particular standards) and the actual wealth you will have upon exiting your business once all taxes and transaction fees have been considered. For many SME business owners, 70% or more of their wealth is tied up in the value of their business, thus any wealth gap that may exist is largely predicated on the value of the business being lower than anticipated upon exit. The wealth gap is a real concern to owners since many have never obtained a valuation of the business nor understand the value-drivers of it. Thus, addressing the wealth gap can seem like a daunting task. However, through undertaking a value acceleration program and giving yourself enough preparation time, this wealth gap can be diminished or even eliminated.

Income Gap

The income gap relates to the income generation ability of the company and its relationship to industry peers. One of the most common economic metrics used when valuing a business is normalized EBITDA (or Earnings Before Interest Taxes Depreciation and Amortization). When we divide EBITDA by a company’s revenues, we obtain the company’s EBITDA%. We can then compare this metric with industry peers. For example, once we normalize income, is the business above or below average—or perhaps best in class? All this will play a role when the valuation of the business is performed.

Value Gap

The value gap represents the difference between what your company is worth (or more precisely, the multiple at which it is valued) versus similar companies. A simplified expression of the value of a business is its EBITDA times a multiple. The multiple is comprised of many variables such as the expected growth rate of the business, industry prospects, and company specific risk factors. It is common for many middle market businesses to trade at multiples much lower than sophisticated public or larger private companies since these companies tend to have higher expected growth rates and lower risk attached to their cash flows. The multiple of a company is subjective based on both specifics of the given company and market conditions at the time a company is valued.

Mitigation of Gaps

How can we systematically attack each of these gaps? Let’s tackle these in reverse order.

To address the value gap, we need to complete four important steps:

- prepare a valuation of the business;

- analyze the key value-drivers of the business;

- prepare a holistic growth plan to improve the existing weak value-drivers (taking into account short, intermediate, and long-term objectives); and then

-

execute the plan through creating an accountability system.

Remember, you as a business owner do have some control over the value of your business along with how it might be perceived by potential buyers! Improving the value of your business (in other words, value acceleration) is really about three things:

- improving the absolute size of free cash flows generated by the business;

- increasing the long-term growth rate of the business; and

-

minimizing the risk that is specific to the company itself (often referred to as company-specific risk).

You’ll never be able to make a perfect company but you certainly can tackle some high-priority items or low-hanging fruit that can improve the value of your business. Remember that items ii) and iii) above directly impact the multiple of your business while item i) is what the multiplier is being applied against. All three elements are important to manage.

An Example

Consider this example:

Assume your business has an EBITDA of $3,000,000 and can likely sell for a multiple of 3x based on recent market transactions. That means your business is approximately valued at $9,000,000. Let’s now say you undergo a value creation program on your business over the course of a few years. Let’s be conservative and estimate you only improved the cash flows by 10% and also improved the potential multiple by 10% (due to de-risking the business and making small changes to facilitate growth). In this scenario, your business can now generate $3,300,000 in cash flow with a multiple of 3.3x. Nothing earth shattering was done to improve the business other than small, incremental improvements. What is the value of the business now? It’s $3,300,000 x 3.3x = $10,890,000 or 21% higher than before! You can see that in this instance the 10% improvement created a 21% uplift in the business value. Larger and more successful value acceleration programs can have an even larger effect. For example, if we could double cash flow and double the multiple, the enterprise value of the business would be $36,000,000 or a 400% increase in business value. Of course, value acceleration requires commitment, persistence, and a disciplined approach towards addressing the value drivers of the business but this scenario above serves to illustrate the potentially dramatic impacts of undertaking such a strategy.

The income gap of the business can also be addressed through a value acceleration system. One of the things a valuator will assess when performing a business appraisal will be how the organization’s normalized income compares to industry peers. This is important because a prospective buyer wishes to understand the enterprise’s relative ability to generate economic profits when placing a bid on a business. An income gap between your business and its peers will impact the valuation! Understanding where you are compared to similar businesses through a benchmarking analysis is a key step in any value acceleration program. Once you understand how your business benchmarks against similar companies, an action plan can be drawn up to make improvements to close the income gap and thus improve the valuation.

Through addressing both the value and income gaps that may exist, owners can correspondingly decrease or eliminate any wealth gap that may have existed—or potentially retire with a far bigger nest egg than they ever thought possible. The important thing to remember is that if you don’t know these gaps exist in the first place, you can never address them. Thus, I’ll conclude by giving you a short but important to do list:

- Talk to a financial/wealth advisor and figure out how much money you need to retire comfortably. If you don’t have a financial/wealth advisor right now, find one right away!

- Once you know what your retirement nest egg should be, obtain a valuation of your business. Find one who has experience with exit planning and can address both the value drivers of your business and industry benchmarking.

-

Once i) and ii) have been addressed, you will know both your wealth, income, and value gaps that may exit. Work with a qualified value advisor to develop a comprehensive growth and exit plan for your business.

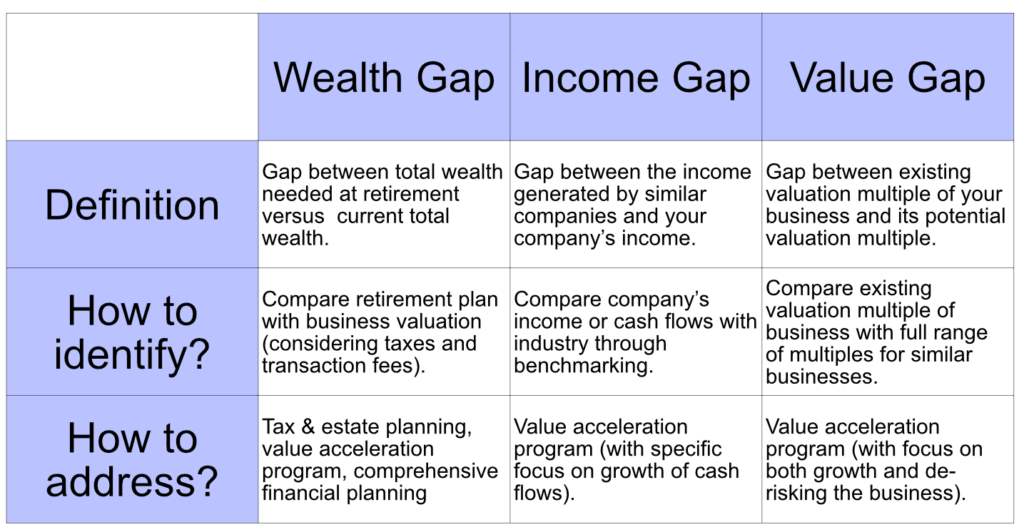

Below is a summary of the various gaps, how to identify them, and finally how to minimize these gaps.