Introduction

As we discussed in Part I and Part II of this series, private equity firms value a number of quantitative and qualitative factors when purchasing a business. In Part III, we will discuss the valuation side of the equation. Because most private equity firms are seeking out quality firms with potential to scale, quantitatively PE firms will desire companies with the following qualities:

- Predictable and sustainable revenue

- Predictable cash flows, and

-

Potential for multiple arbitrage.

Predictable & Sustainable Revenues

It is important to understand that revenue growth is not enough to make a company valuable—revenue growth must be both predictable (we can forecast revenue at least a year or two into the future), and sustainable (revenues are not going to suddenly fall of a cliff because it is composed one-and-done customers or where customer contracts all terminate in a similar time frame). If you are going to attract attention from PE firms, understanding where your revenues are coming from in both the short-to-long term is critical. Revenue sustainability refers to the ability to keep customers coming back. This can be realized through customer contracts but there are also a number of strategies that can be employed that incentivize customers to remain loyal for years. Sustainability also implies that prudent business strategies are being employed to drive growth rather than value-destructive policies that will only result in the company failing. For example, top-line growth can be achieved by bringing in low-profit customers, but ultimately unless your company is super efficient, this strategy will backfire.

Revenue growth is an important metric to PE firms. A company with flat top-line growth may not be appealing to PE firms unless there is something scalable about the business that can be implemented post-acquisition. However, an ideal company is one that can grow at double-digit growth year-in, year out.

Predictable Cash Flows

Beyond top-line growth, companies need to have strong margins. Most times, cash flow is defined as EBITDA, although operating margins and free cash flow may also be metrics used when analyzing a company. Similarly, EBITDA margins provides a measure of the true economics of any business. Private equity acquirers will ideally want to see expanding margins over time with room for further growth. In contrast, inconsistent EBITDA margins will be a potential red flag to an acquirer since it may suggest a flaw in the business’s strategy.

Free cash flow is also an important consideration and should account for working capital, capital expenditures, and any growth-related investments. While operating cash flow might be predictable, we need to predict these other aspects since they also play a role in the valuation of the business.

Multiple Arbitrage

PE firms like to play the game of “multiple arbitrage”. That is, they invest in companies with the belief they can buy at one multiple, improve the business, then sell at a higher multiple. There are also different types of PE firms, some that specialize in the Lower Middle Market while others focus on larger companies. In some cases, a smaller private equity firm may sell to a larger PE firm with different expertise. The prospect of multiple arbitrage allows the potential of a series of acquisitions and exits over time.

Are PE Firms Financial or Strategic Buyers?

Traditionally, PE firms have been viewed as financial buyers because they are interested in valuing the firm based on the intrinsic value of the company at the time of acquisition. However, with increasing competition in the PE market and the drive to generate returns—uninvested assets generate next to no return)—some PE firms may effectively have become strategic buyers. That may be true where PE firms buy “bolt on” acquisitions to enhance current companies in their portfolios. Also, a PE firm’s willingness to pay up for a potential acquisition may increase if it has pressure to invest its otherwise unproductive cash.

Multiples & Trends

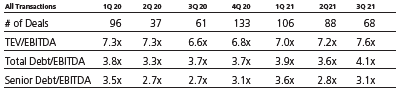

Trends in acquisition multiples tells us a lot about the marketplace since private equity usually represents sophisticated investors. Multiples from the past eight quarters are shown below. [Note 1] Note that these multiples are averaged for companies with enterprise values ranging from $10 million to $250 million. In general, larger companies will be normally acquired for larger multiples.

You will note that the number of deals declined significantly in 2020 Q1, which was the height of the pandemic lockdowns. Cash flow multiples did not suffer much until Q3 and Q4 (although the mix of companies being sold could have contributed to this). In the third quarter of 2021, multiples were their highest in the past two years, although volumes of PE acquisitions have slowed somewhat since Q4 ’20 and Q1 ’21. However, I suspect that the increase in these quarters was a delayed reaction due to the pandemic with more recent quarters reflecting normal volume of deals. The bottom line is that valuations have not suffered during the pandemic and now that things are slowly returning to a degree of normal, deal volume and valuations are skewing positively.

Coming up in Part IV, we will tie everything together and discuss what this really means for a Middle Market business owner.

Note 1–Copyright GF Data, 2022. All rights reserved. Used with permission.

Enjoy this article? Subscribe to our newsletter here.

Want to talk? Book a free appointment here.